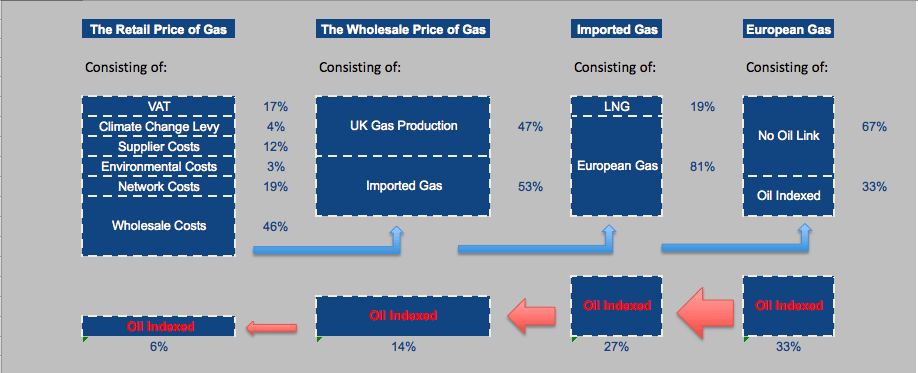

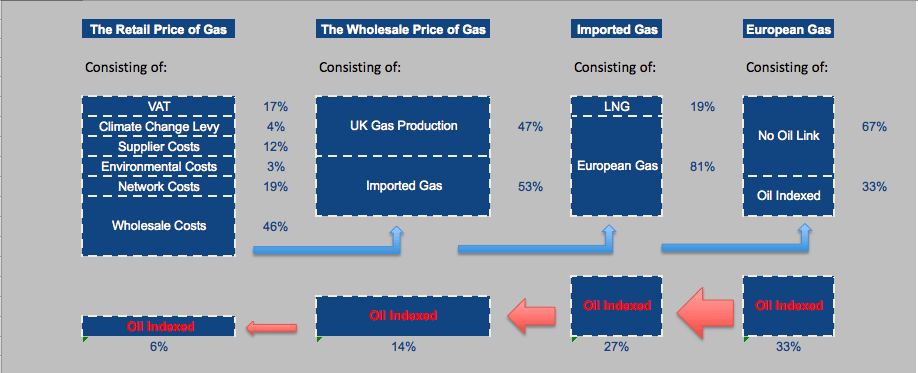

Gas is extracted at a cost, transported at a cost, administered at a cost, a margin is added on, as are the costs of sale and you pretty much have how gas gets from the ground to your meter and at what cost. The raw gas price itself is driven by the cost of extraction. In addition like any market, the more product there is available to meet the demand the lower the asking price and vice versa. The price of gas is therefore driven by a number of interconnected factors. This is not a natural phenomenon it is an economic one. The gas price in the UK has only a small exposure to the oil price because the gas we produce has no connection to the prevailing oil price whilst just 33% of that which we import from Europe (53% of all our gas supply in 2013) is from continental gas contracts that are linked to the prevailing oil price. The level of the oil price therefore has a much diminished impact on the cost of gas than popular expectation with just 6% of the overall retail price of gas in any way influenced by the oil price. The infographic below illustrates the reduced influence of oil:

What else drives the cost of gas?

- Continental Prices – The interconnector between the UK and the continent facilitates the flow of gas in either direction, going where the best prices are to be had, artificially creating an imbalance between supply and demand

- Gas field maintenance – Just to get the gas extracted from its source is a huge operation, requiring significant planning, preparation and ongoing maintenance. This comes with a commensurate level of cost.

- Exchange rates – Cross border trading is exposed to the relevant exchange rate of the parties involved. Exchange rates also have historic links to set currencies and its price continues to be associated with these currencies as a basis for gas deals to be transacted

- Demand – The demand for gas is simply how much is needed at a particular point. This is driven by temperature, the economic cycle, individual user behaviour and the generation needs for gas being used to produce electricity rather than as a fuel source in its own right.

- Storage costs – Unlike electricity, gas can be stored to be used later but doing so, like extraction, needs planning, expenditure and upkeep. All costs that need to be recovered via the end product price.

- Shipping costs – Liquid Natural Gas (LNG) shipments enable stored gas, using this technique, to cross oceans and to be delivered where the demand sits.

- Time to delivery – In classic economic terms, the greater the demand and the sooner that demand is needed to me met the more it will cost to secure it.

From where does the UK’s supply of gas come?

The United Kingdom Continental Shelf (UKCS) – The UKCS or the gas fields of the North Sea and beyond have long been a major source of our gas needs. These reserves are now running low or a lessening in their economic viability as extraction costs and the gas price move in opposite directions.- Norway – Norway is a large contributor of our gas needs, the relative neutrality and benign nature of the country lessens the natural sensitivity around import dependency.

- The UK interconnector – The UK interconnector, a network of pipes linking us to continental Europe moves gas supply to and from the continent. Naturally the relative cost either end of the pipe determines the flow of this gas. Interconnector Gas supplies would appear to be attracted to demand like magnets to iron-filings. The UK Interconnector has also enabled the flow of gas, via the Ukraine, from Russia. This increasing dependency on less stable states is the fundamental concern that centres on security of supply.

- LNG – LNG shipments, transporting stored gas around the globe is unloaded at specially developed terminals around the UK coast. A strong source of gas, this technology is subject to significant worldwide demand and inherent to its nature will move where the demand and money lays.

- Storage – Realising reserves from pre-existing storage provides a crucial supply of gas. Indeed it is these reserves, and their sometime dwindling nature, that are the subject of governmental concern to ride-out any blockages in the interconnector or LNG supplies.