What’s in it?

The gas price you pay on your bill is made up of a number of constituent parts –

- the raw energy cost (or wholesale cost)

- the cost of transportation (or transmission & distribution)

- losses (or unbilled volumes)

- levies (or environmental and social obligation costs)

- metering costs (or supplier operating costs)

- the supplier’s margin (or profit)

What does it look like?

Once all these costs are factored in, the gas price will sometimes be represented in two elements:

- Unit rate(s)

- A standing charge

At other times there will only be a Unit rate present. As a result the energy price can be levied against both the number of kWh you consume (your unit rate(s)) and the number of days you are ‘on supply’ (your standing charge) or just the kWh’s consumed.

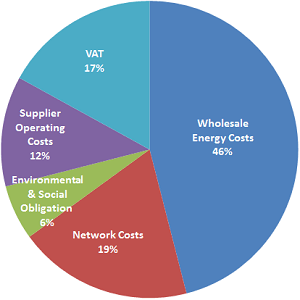

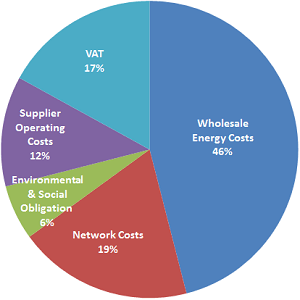

How much does each element contribute?

If we take a notional cost of

5p/kWh for a unit of gas we can clearly see the contribution of each element. The constituent parts of the gas unit price can be broken down into 4 key elements:

- Wholesale Costs

- Network Costs

- Environmental & Social Obligation Costs

- Supplier Operating Costs

In addition to which, VAT and Climate Change Levy will be applied.

1. Wholesale Costs

The cost of the energy supplied: 2.30p/kWh or 46% of the overall cost. This is made up of:

a) The raw energy cost – 2.04p/kWh

The largest element of the gas price is inevitably the cost of the raw commodity, however this might be less than you would expect at 41% of the total price or 2.04p/kWh in a headline energy rate of 5.0p/kWh.

b) Energy Losses in the network – 0.06p/kWh

As gas travels along the networks from the producer to the customer meter there occurs a natural inefficiency whereby gas is lost along the route. As a result this gas will never be ‘metered’ and paid for unless an assumption of the rate of losses is made and this ‘unbilled volume’ is added to the final price. Losses make up about 1.1% of the gas price or just over 0.06p/kWh in our example.

c) Reconciliation by difference – 0.1p/kWh

d) Demand forecast error – 0.1p/kWh

The gas industry is ‘settled’ or ‘balanced’ daily, demand and supply do not always match, as a result a number of ‘fudging’ factors are used to ensure the system balances between production, storage and demand. This is where compensatory payments for what is known as ‘Reconciliation by Difference’ and ‘Demand Forecast Error’ are loaded into the price to take account of the potential inaccuracies, physical or otherwise, in the market.

2. Network Costs

The cost of transporting the gas to the meter: 0.94p/kWh or 19% of the total cost. The second largest element is the cost of transportation of the gas across both the transmission network and the local distribution network. This consists of:

a) Distribution costs – 0.85p/kWh

It is the latter, the distribution network that costs the greater part of the transportation charges at 17% or 0.85p/kWh in our headline rate.

b) Transmission costs – 0.09p/kWh

Transmission by contrasts costs just 1.7% or 0.09p/kWh. The supplier will pay the relevant regional distribution network for their services; these are now privately owned enterprises often with multiple regions under single ownership. These businesses are required to publish their tariffs so that suppliers can accurately forecast and charge the customer appropriately to cover their costs. The transmission costs are payable to the controlling entity such as National Grid, and the costs are directly related to the length of the network that the commodity travels through in order to reach the required entry point into the distribution network.

3. Environmental & Social Obligation Costs

The cost of supporting various government initiatives through the energy price: 0.14p/kWh or 2.8% of the price Government ‘green’ initiatives are much less prevalent in the gas market than they are in the electricity sector, however there are still two key levies on the gas price. These are:

a) Gas Energy Companies Obligation – 0.1p/kWh

The Gas Energy Companies Obligation or ECO is a scheme levied on suppliers to invest in customer efficiency projects such as subsidised loft insulation which contributes 2% to the overall price. Higher Distribution Cost Levy – 0.04p/kWh A different sort of levy, this time to support remote networks and subsidise the otherwise cost prohibitive activity of transporting gas to those regions. Currently only focussed on the North of Scotland this charge is levied on all customers as part of the gas price, making up 0.8% or 0.04p/kWh.

4. Supplier Operating Costs

The cost of actually delivering the supply to you, the customer: 0.62p/kWh or 12.3% of the retail price. The penultimate cost contribution to the gas price is the costs to the supplier in delivering the services to the customer as well as their profit. These include the cost of metering, both the provision of the meter itself and the reading and data handling responsibilities. The supplier appoints a third party metering agency, who like the distribution companies were once part of the wires and retail network but are now under private ownership, sometimes they are part of the distribution network, sometimes independent. The level of charges for their services vary by meter type and the technology used and the supplier relies on these relationships to source the reads from your meter and to ensure sufficient data is collated to facilitate accurate estimation where an actual reading is not available. These costs, covering the operational costs of the supply business such as their cost of sales and their profit contributes another 12.3% or 0.62p/kWh to the final gas price. This margin for our example price and an average business gas customer consuming 75,000 kWh would equate to around £461 per customer per year to cover all the supplier costs and any profit on a bill of £3,750 Of course any supplier that also owns production assets has the potential to make additional margin from this element too.

5. VAT and Climate Change Levy

The cost of additional government taxes on the energy price: 1.02p/kWh or 20.3% of the price Two further government taxes are applicable to business energy costs:

a) VAT

Business gas is subject to a

VAT rate of 20%

b) Climate Change Levy

Climate Change Levy is applicable to every unit of gas used and is currently (2014/15) charged at the p/kWh rate of 0.188p/kWh.

The Final Tally

Once this is all the above is taken into consideration we can therefore conclude that the proceeds from the price of gas you pay is split between:

- 45.9% going to the generators

- 23.2% going to the government

- 18.6% going to the networks, and

- 12.2% going to the energy supplier

And there you have it, how the gas price is made.

| Electricity | | Gas | |

| Wholesale Costs | Wholesale Energy | 33.9% | Wholesale Energy | 40.8% |

| Unbilled Volume (Losses) | 1.1% | Unbilled Volume (Losses) | 1.1% |

| | | Reconciliation by Difference | 2.0% |

| | | Demand Forecast Error | 2.0% |

| Imbalance Costs | 0.1% | | |

| Network Costs | Transmission Costs | 5.2% | Transmission Costs | 1.7% |

| Distribution Costs | 16.8% | Distribution Costs | 17.0% |

| Balancing Costs | 0.9% | | |

| Environmental & Social Obligation Costs | Renewables Obligation | 6.1% | | |

| Contracts for Differences | | | |

| Energy Companies Obligation | 2.5% | Energy Companies Obligation | 2.0% |

| Feed in Tariff | 1.6% | | |

| Higher Distribution Cost Levy | 1.0% | Higher Distribution Cost Levy | 0.8% |

| Govt. Funded Rebate | -1.8% | | |

| Supplier Operating Costs incl. Metering | | 11.8% | | 11.8% |

| Depreciation & Amortisation | 0.6% | | 0.5% |

| VAT | | 16.7% | | 16.7% |

| Climate Change Levy | | 3.7% | | 3.7% |

| | 100.0% | | 100.0% |

For more information, or if you simply want us to get the best deal for your business gas, simply call us on 0800 051 5770, we’d love to hear from you.

The gas price you pay on your bill is made up of a number of constituent parts –

The gas price you pay on your bill is made up of a number of constituent parts –