Phil Blunt, Energy Analyst shares his views on the industry and why he doesn’t envy the job of the energy suppliers…

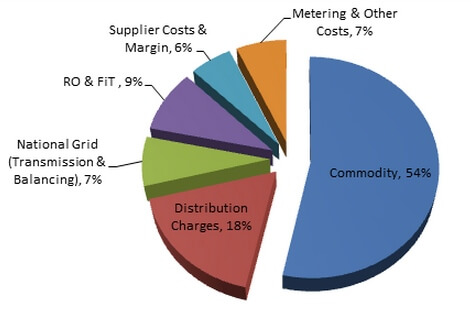

The raw cost of power is the major portion of the final price paid by the consumer and makes up over 50% of the total cost to supply for the average business user. The other 50% is made up of 3rd Party Charges (TPC’s).

When offering a fixed price to the customer, a supplier has budgetary certainty of these costs. This is because the visible market today shows what the commodity cost of power is through to 2019,

However, for TPC’s, the supplier has to take a leap of faith.

TPC’s change once a year (generally on 1st April) and therefore the supplier will only accurately know what the charges are for the current year.

For the remaining years of any multi-year contract, the supplier will have to estimate what these costs will be for the years to come. Imagine the problems in trying to provide a 3-year quote to a customer when only 50% of the overall costs are actually known.

The latest figures of the breakdown of energy charges are as follows:

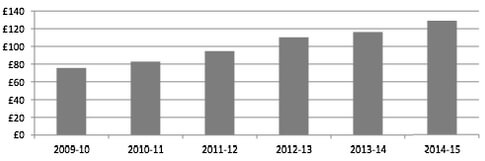

The National Grid (Transmission & Balancing) charge is 7%, these have increased by 133% from 3% of the customer bill in 2009-10.

And this is just one TPC, all TPC’s are increasing just as rapidly and will continue to do so as the industry needs to cover the costs of maintaining an ageing transportation infrastructure alongside providing new ‘wires’ for the future.

As you can imagine, the cost of installing the power lines and cables to carry the power from hillside or offshore wind farms to home and business is not cheap!

This is not the only increasing cost that the supplier has to deal with. Government requirements for Renewable generation mean ever-increasing costs are levied on the supplier (and in turn on to the customer).

Feed In Tariff charges caught many supplier on the hop following its rapid price rise and some Suppliers had to invoke clauses within their T&C’s where they could claw back these increasing costs from the customer who believed they were on fixed price contracts.

Such action by a supplier – especially acting alone – is not recommended as it could take years to rebuild confidence with brokers and customers alike.

But there’s more, on the horizon are further changes to the industry as Electricity Market Reform kicks in from 2016. This strategy to support renewable targets and guarantee security of supply carries a current estimate of adding an extra 1 to 2.5 p/kWh onto the average business customer’s bill by 2021. That’s a heck of a charge. For the average business electricity customer that equates to a £500 increase in their annual energy bill just for government initiatives unconnected with the actual energy being used or the third party charges being levied!

Not only is there uncertainty as to what all this means today, none of these charges are finalised for future years and therefore to offer 3 or 4 year contracts, the supplier has to get their guesstimates right otherwise they could be supplying at a loss.

That might feel like schadenfreude for energy suppliers but the logical conclusion is either only offering variable price contracts with risk in-built to cover unexpected costs or to simply pull out of long term contracts altogether.

Maybe, rather than kicking them then, we should pity the supplier who has to estimate all these costs so that fixed prices can be offered to the consumer?

Unlikely! But the alternative could be worse.